2024 Irs Form 1040 Schedule 2 – One place you can start your advance tax planning is with the standard deduction amounts for 2024. Fortunately, the IRS has already released the standard deduction amounts for the 2024 tax year. The . But last year, the IRS delayed the $600 tax reporting rule for payment apps, meaning that similar to prior years, users of cash apps would only receive a 1099-K tax form if they made $ threshold .

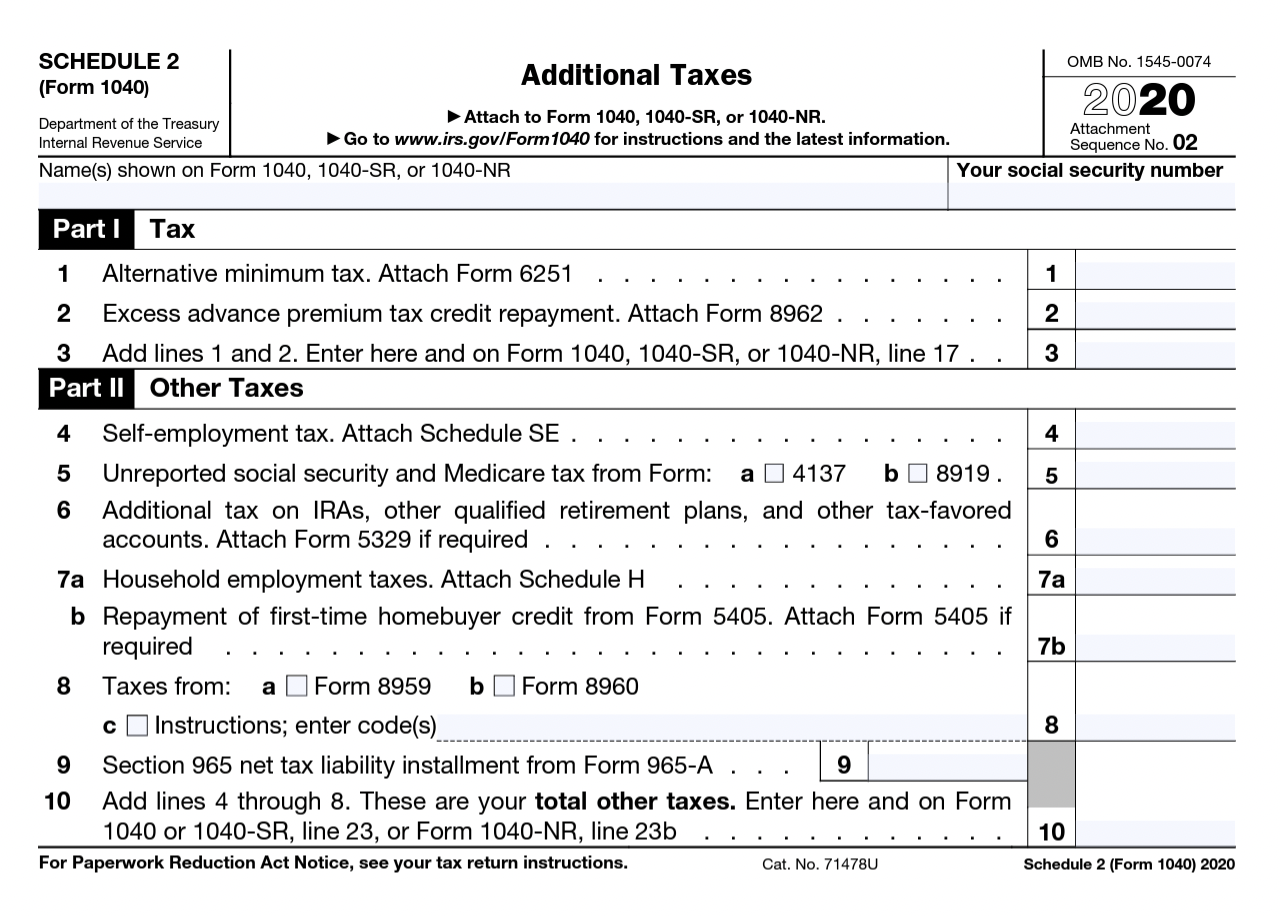

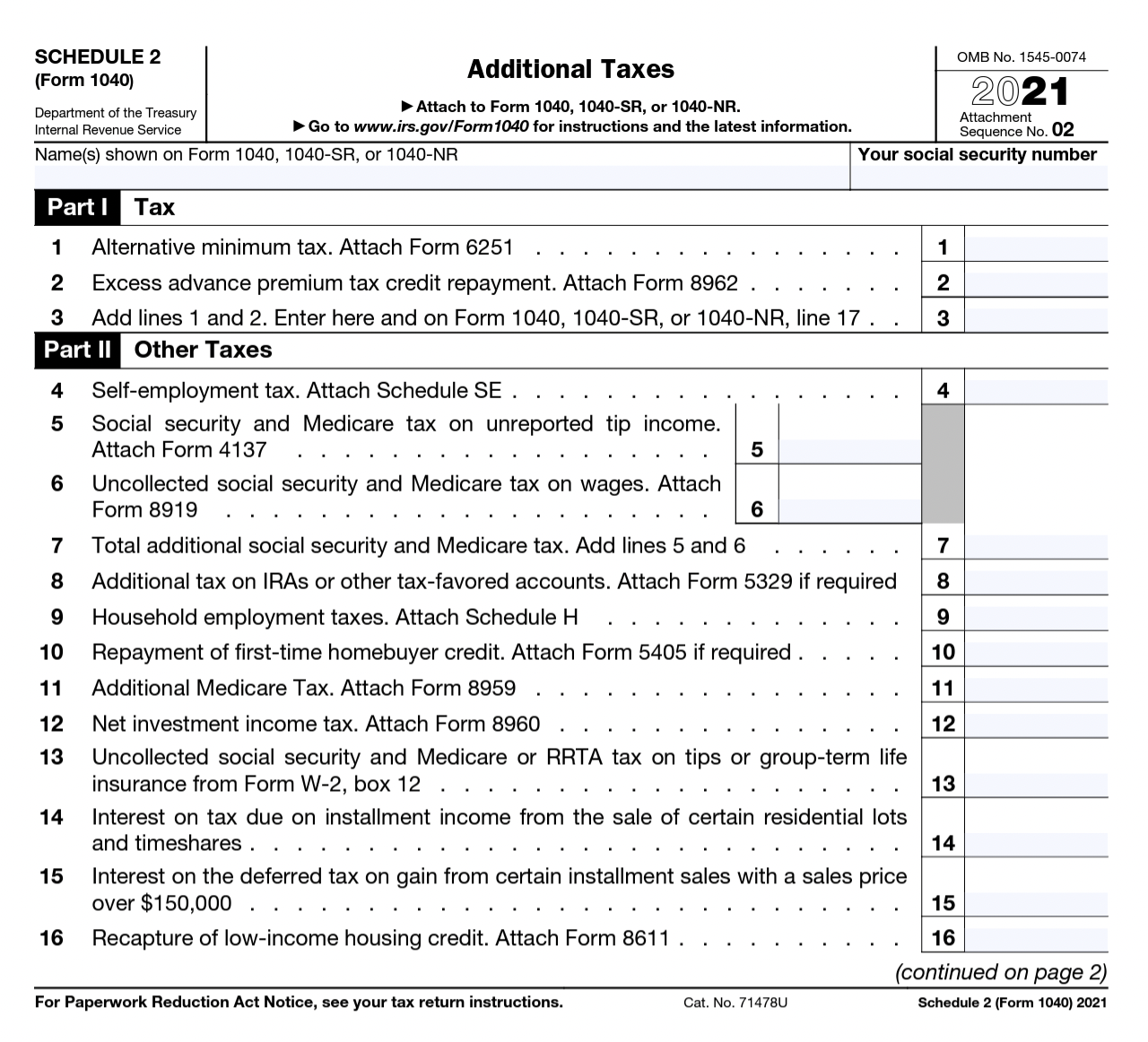

2024 Irs Form 1040 Schedule 2

Source : tuition.asu.edu

IRS Schedule 2 walkthrough (Additional Taxes) YouTube

Source : m.youtube.com

What is IRS Form 1040 Schedule 2? TurboTax Tax Tips & Videos

Source : turbotax.intuit.com

Most commonly requested tax forms | Tuition | ASU

Source : tuition.asu.edu

Form 1040 Schedule 2 Guide 2023 | US Expat Tax Service

Source : www.taxesforexpats.com

Most commonly requested tax forms | Tuition | ASU

Source : tuition.asu.edu

Tax Transcript Decoder: Comparison of 2021 Tax Return and Tax

Source : www.nasfaa.org

Publication 505 (2023), Tax Withholding and Estimated Tax

Source : www.irs.gov

Most commonly requested tax forms | Tuition | ASU

Source : tuition.asu.edu

Tax Transcript Decoder: Comparison of 2021 Tax Return and Tax

Source : www.nasfaa.org

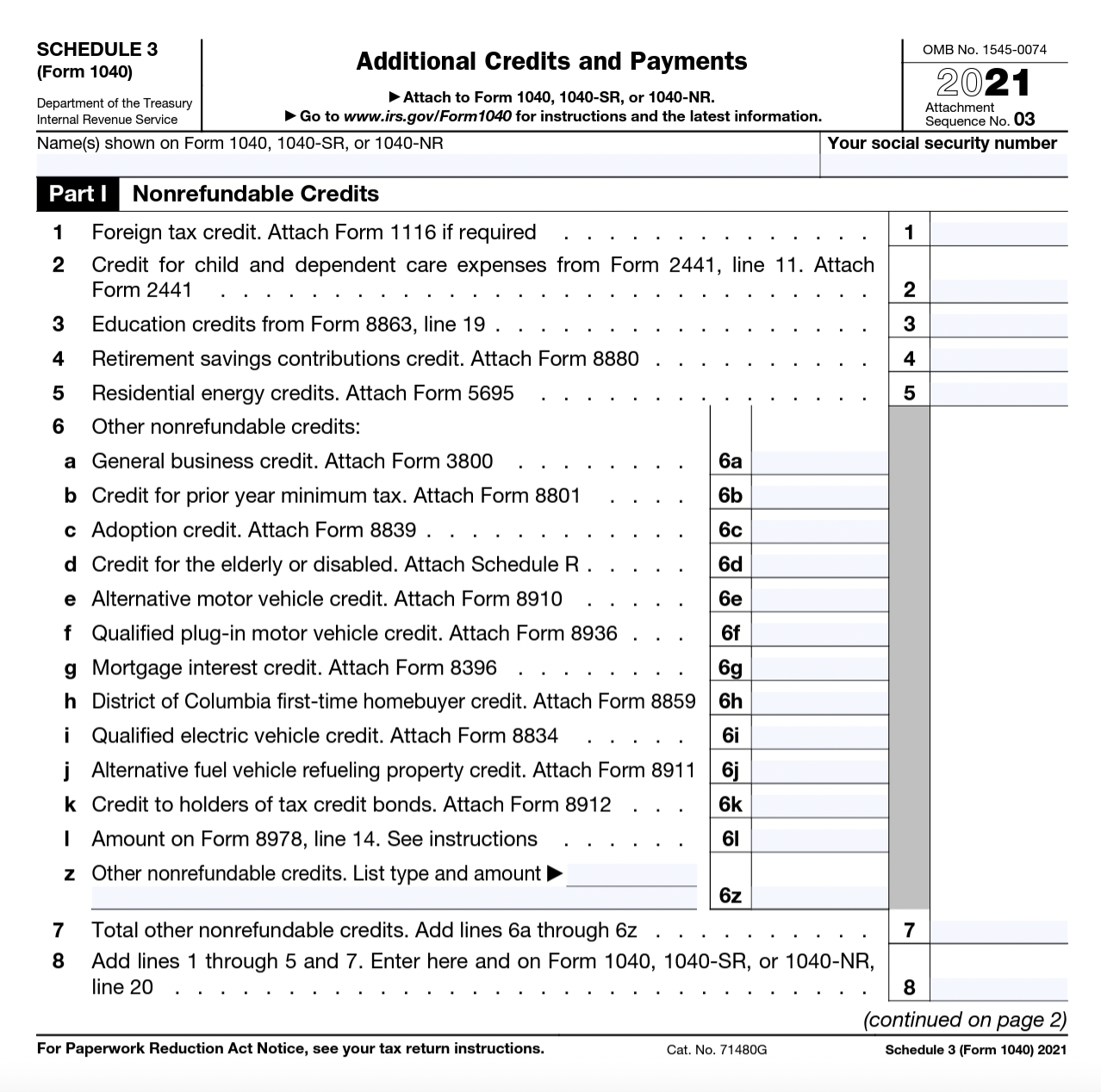

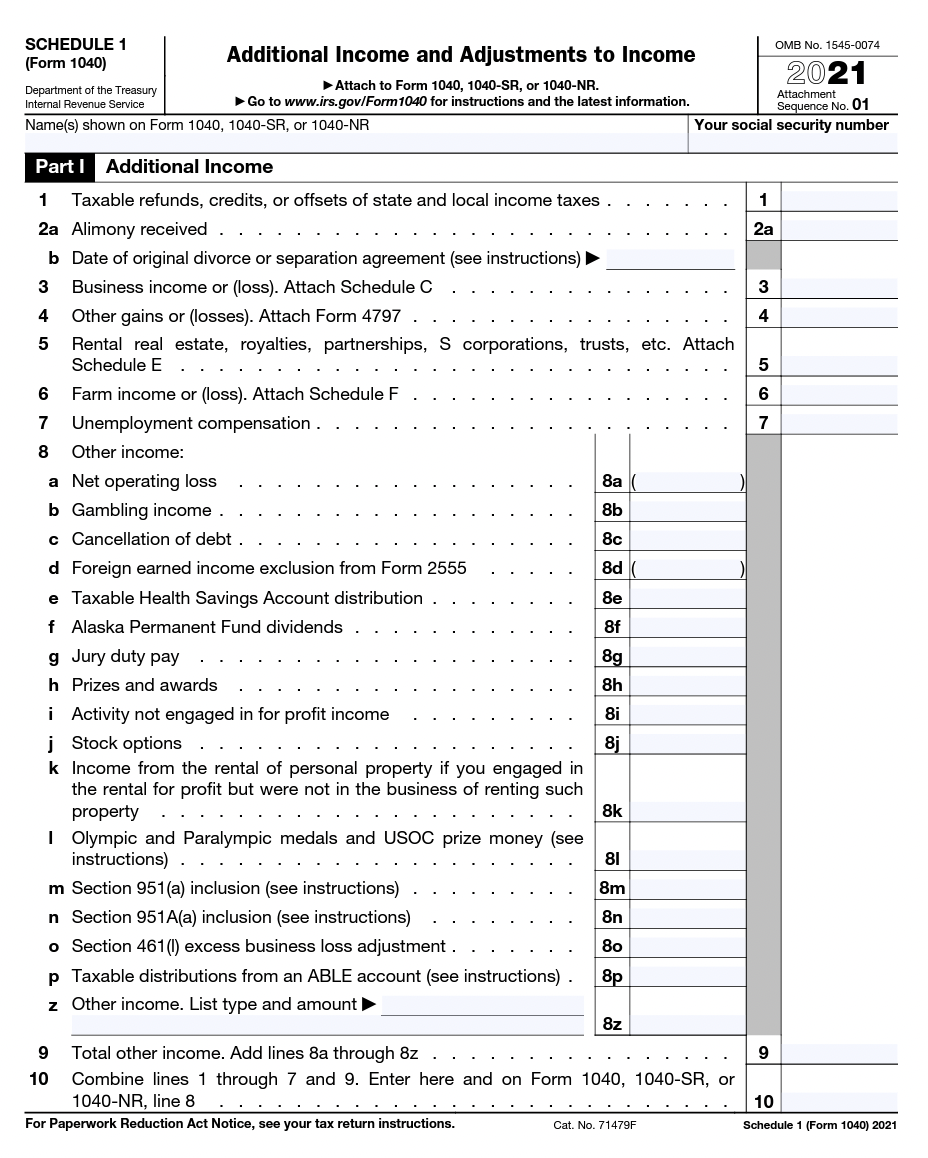

2024 Irs Form 1040 Schedule 2 Most commonly requested tax forms | Tuition | ASU: A schedule is a form that collects information about specific types of taxable income and activities. People who have simple tax returns may not have to worry about anything but Form 1040 (the main .. . The IRS again delays law that would have required Ticketmaster, Venmo, and others to issue 1099-Ks to those with more than $600 in revenue in 2023. .